The medical technology industry is slowly expanding its patient engagement work. Barry Liden, Edwards Lifesciences, explains why the sector is playing catch-up and how listening to patients can add value

Compared to their counterparts in the pharma sector, MedTech companies are late-comers to patient engagement. However, there are clear signs that medical technology developers – ranging from diagnostics and digital devices to surgical tools and cardiac implants – are working with patients at an unprecedented rate.

Barry Liden, Vice President, Patient Engagement at Edwards Lifesciences, says some companies in the sector are exploring expanding engagement with patient organizations and advocates. But it’s still early days. While training and guidelines on interacting with patients will help, there are some structural reasons why MedTech lags pharma on the PE front.

‘One of the reasons pharma is further along than the MedTech industry is that the relative value of patient perspectives in the development of MedTech products is not appreciated yet,’ Barry explains. ‘Cost is part of the equation. The scale of drug development projects is much larger than in MedTech.’

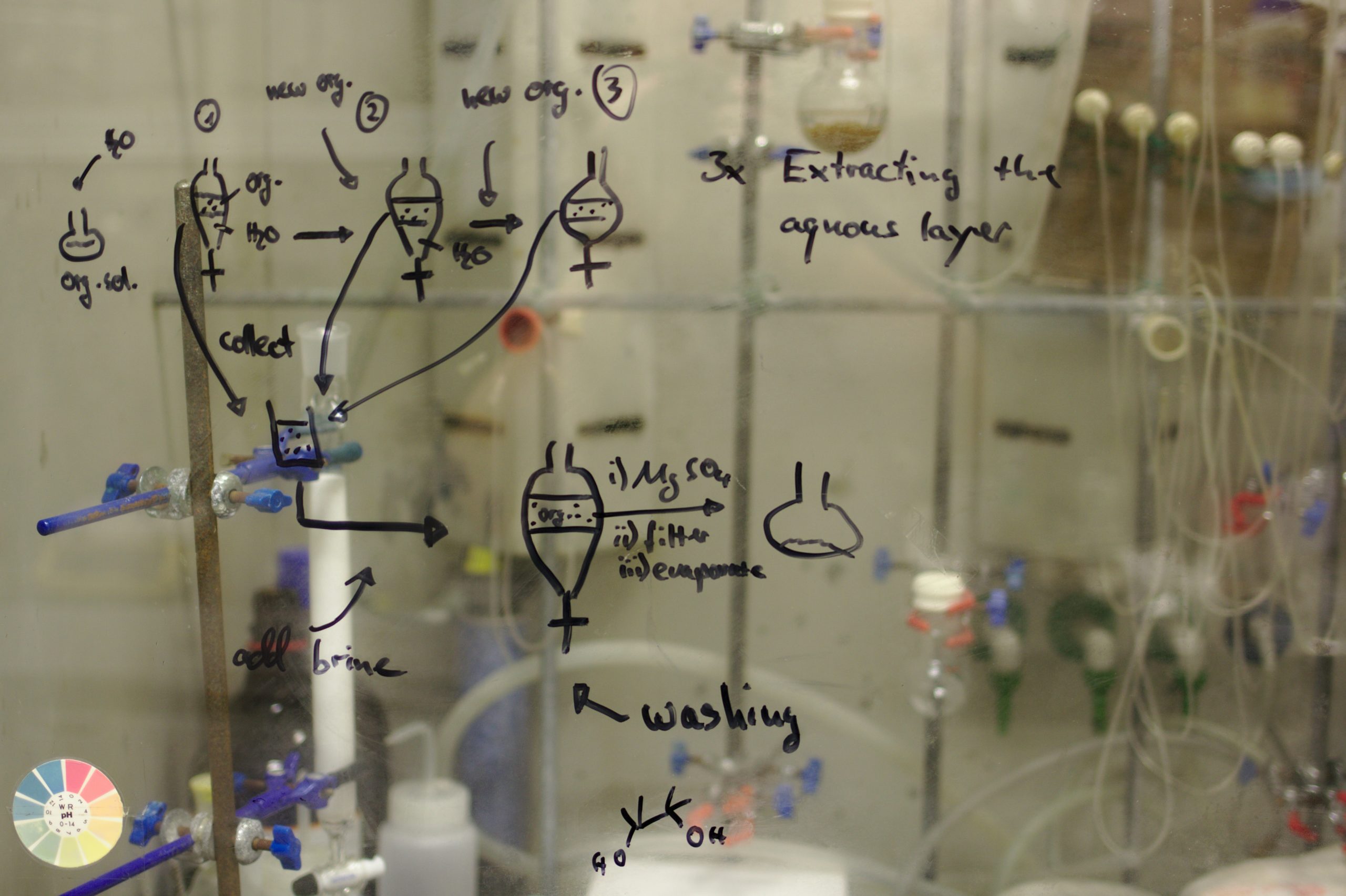

Another key difference is the way in which medical technologies are tested. Unlike medicines, most medical devices do not undergo large-scale clinical trials. Even for medical implants like the artificial heart valves that Edwards produces, sample sizes of clinical studies are much smaller than for medicines. ‘Recruiting patients has not been as challenging in the past as it has been in pharma. Traditionally, many device companies have relied on physicians or hospitals to identify suitable patients for a new product.’

Patient retention is also less of a concern. In a heart valve study, for example, the patient undergoes a single intervention – heart surgery – and is followed up by doctors. But this is done over a much shorter timeframe than a medicine trial in which the patient takes a new medicine for months or years. ‘The idea of involving patients in trial design may only apply to a subset of MedTech products. But over time, we find ourselves doing larger trials than in the past, so the need is evolving.’

Engaging end-users

The other key difference between MedTech and pharma is the end-user. For medicines, the user is ultimately the patient – they are usually the ones who will administer the medication. For surgical tools or implants, the patient experiences the effect of the product but the user is more likely to be a physician.

This may not be true for diabetes monitors, epipens, and sticking plasters, but huge numbers of medical devices and machines used in lab tests are never seen by the public. When it comes to deciding which technologies to use, the decision is primarily influenced by physicians and hospital procurement offices – a source of frustration for some patients seeking access to innovative tools. Greater patient input into regulatory and purchasing decisions would be essential to a truly patient-centred system.

One area where some companies are becoming more open to patient voices is in deciding where their research and development work should focus. ‘Our industry is slowly starting to involve patients in priority settings about what types of attributes are desirable and what outcomes devices should seek to impact.’

Building momentum

As MedTech companies build up their patient engagement capacity, it is helpful to have a centralised office to coordinate this work. ‘Patient engagement activities are already happening across multiple functions within companies,’ Barry says. ‘At Edwards, we’ve always had a patient-focused approach to our work. But we’ve discovered it can be more efficient to apply a hybrid approach: a centralized function to help provide focus, metrics and coordinated resources and activities so that we avoid duplication of effort. Our goal is to enable any function or business to engage patients directly without necessarily having to go through our team. This also improves the experience of patients who engage with us.’

The company is beginning to feel the benefit. ‘Bringing patients in improves our expertise which helps the whole company,’ says Barry. ‘It can also be rewarding for patients to inform our work and, in some cases, to meet the engineers who made their heart valve.’

‘Connecting employees and patients can bring huge value to both parties. Colleagues find it inspiring and it helps to enhance our patient-focused culture,’ Barry says. ‘When we hold patient listening sessions, we gain insights that help to improve our products and help ensure patients are getting access to the right treatments.’

Smaller MedTech companies, of which there are many, may struggle to prioritise patient engagement. Established firms like Edwards, on the other hand, have a critical mass of activity that can make it worthwhile. ‘Crucially, our CEO and Executive Team see value in it,’ he says. ‘It’s an investment and some of what we are doing is a bit experimental, but that’s how we innovate.’

Barry says every employee should have a role in working with patients but, for most, it’s a new concept. Expanding education for the industry, and deepening patient knowledge of MedTech, could help extend the reach of PE in the sector.

‘That’s why we are working with PFMD to develop basic tools that other companies can use,’ he says. ‘We want to reduce the barrier to entry and ensure that PE is done in the right way – a way that is respectful of people and their expertise as patients.’